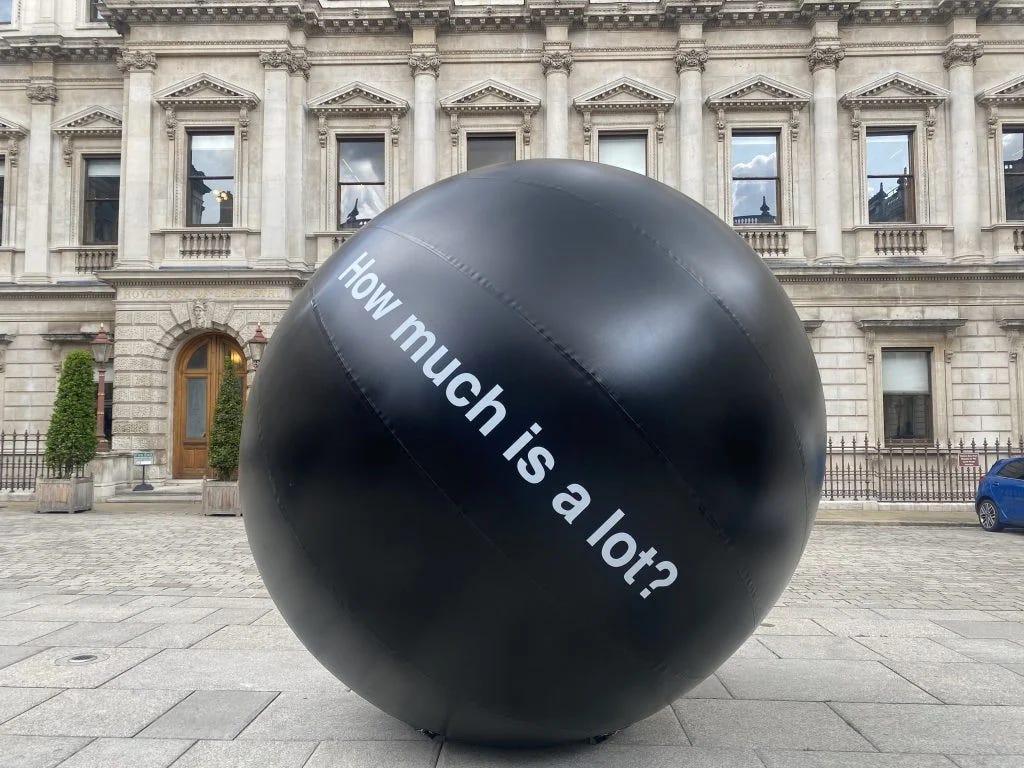

What On Earth is Going On With the Art Market?

As we look back on the most expensive paintings ever sold, it's worth examining the current state of the industry, and the "art-as-investment" mentality.

This year, the spring auction season ended not with a bang but a whimper.

Auctions at Christie’s, Sotheby’s, and Phillips all failed to meet sales estimates. Even as sales at Art Basel (which wrapped up last week) demonstrated an upward tick, the overall trend of the past few years is that art sales have decreased.

I’ve been thinking about the art market quite a bit lately. Over on the Crossroads YouTube channel, my most recent video explored the top five most expensive paintings ever sold, and the answers might be surprising to readers. What I noticed when conducting research for the video was that even when adjusting for inflation, the top five paintings were all sold during the 21st century, but the latest sold in 2017.

This fit a pattern explored in a recent essay by Naomi Rea, the editor-in-chief of Artnet. We have grown accustomed to the ment…